Greetings from James.

Tencent finally revealed the details of Nintendo Switch (TXNS) launch on 2019/12/4. The console will launch with one digital game on 2019/12/10, right before Double 12 Shopping Carnival in China. For those not familiar the details, check Niko Partners’ recap and analysis or announcement on Tencent Nintendo Switch official Weibo account (in simplified Chinese).

Market is conservative on the potential of TXNS due to console market size and game approval process in China. While profit contribution might be negligible in models at initial stage, participants will watch the traction closely and look for signs to update their trajectory projection.

The Tracking Game

Like any platform business, the value of console business in growth phase is most sensitive to user base growth (accumulated hardware shipment / sell-through as a not-so-accurate proxy).

China shipment probably will be buried in Other in Nintendo’s report before it becomes too significant to hide (LTD shipment geographic breakdown by CY3Q19: Japan 24% / The Americas 40% / Europe 26% / Other 10%).

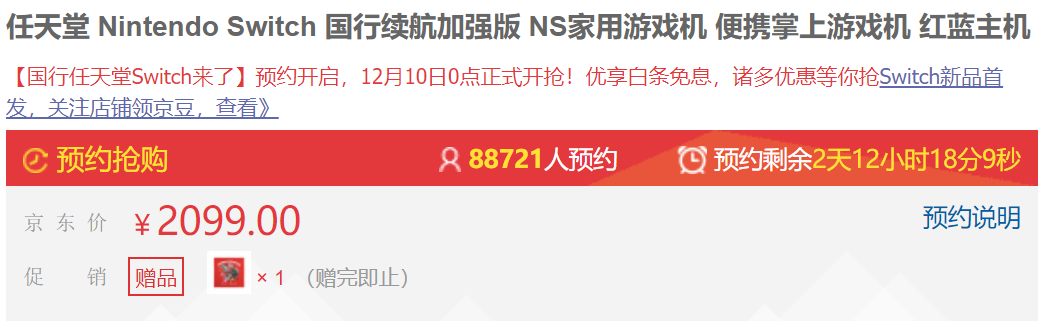

Compared to shipment, sell-through is a metric more up-to-date and on lower funnel to gauge user base. Since reservation / pre-order is only available on online channels and there are “real-time” numbers shown on e-commerce websites, participants focus on those numbers.

There are few things to keep in mind when reading those numbers: conversion, double counting and sell to whom.

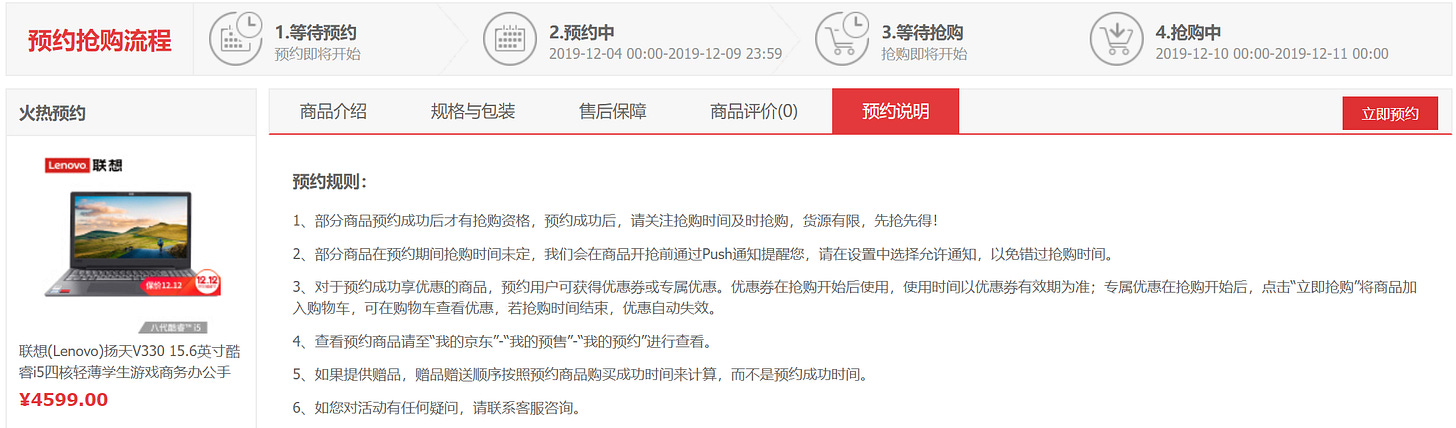

Current stage at JD.com is more like an expression of interest (reserve to be qualified to buy).

While at Tmall, consumers need to pay RMB 100 deposit for the pre-order.

You can expect the number with lower friction is higher (without deposit). As of this writing, the number of people has expressed their interest on JD.com is around 88,700 (JD.com also offers different accessories bundle which requires RMB 100 deposit and uses a different wording, pre-sale. That number is around 3,900) while pre-order at Tmall is around 8,300.

Reservation at JD.com: 88,721

Pre-order at JD.com: 3,870

Pre-order at Tmall: 8,308

Pre-orders are more likely to close while reservation might have “some leakage”. In addition, you might want to have “some haircut” to avoid double counting if you scale up JD.com’s reservation number to estimate potential consumers via Tmall (due to multi-homing characteristic of e-commerce platform).

Suning.com is also participating the reservation game even though Tencent Nintendo Switch does not have an official storefront on the online platform. Suning.com’s reservation number is even higher then the number on JD.com (note: Suning.com is one of TXNS offline channel).

Chinese New Year - Use Case Demo & Community Marketing

By the time of Year of Rat, TXNS should have “more games” but probably still not enough to move the system significantly. However, Chinese New Year (CNY) is an event that moves population at scale. With the mobility, TXNS will travel around China to entertain people just like what it did in 2018 & 2019. This time is different. It will be the first time that D2C relationship in China has been established. TXNS has not only official Weibo account to broadcast to Nintendo community but also direct channel to their gamer base. This is an opportunity for TXNS team to do community marketing to bring in new gamers. The community activities on TXNS during CNY will be the early sign whether TXNS might follow a different product diffusion pattern (is the team capable to make TXNS a hit or just follow typical playbook to market a gaming platform which is fine. It’s Tencent so my expectation is higher).

Side note: It’s actually quite difficult because it involves a physical product and upfront costs for consumers. As a result, some growth hacking techniques for digital product might not work. The brightside is that the team can iterate on digital/community marketing.

There will be noises about how many TXNS sold at launch, by this calendar year, by this fiscal year and going forward. By the time of next briefing, market will have clearer idea how to track China sales and form a trajectory consensus. I will focus on the community activities during CNY to gauge the likelihood of upward revision. I don’t expect much information from Nintendo at next corporate management policy briefing.

Cheers,

James